Considering the Chartered Financial Analyst (CFA) qualification and wondering what is it all about?

Whether you are a current candidate or completely new to the CFA designation, here’s our useful guide which summarizes everything you need to know about the CFA exams.

Popular articles:

What is CFA (Chartered Financial Analyst)?

The CFA Program is world-renowned in finance, and increasingly the “gold standard” for portfolio managers, wealth managers, research analysts, and investment professionals in general.

It is a Masters degree equivalent credential run by CFA Institute, focused on building expertise and real-world skills in investment analysis. Once a candidate passes all 3 levels of the exams and meet the required criteria, they can start using the CFA charterholder title.

Since the inception of the first exams in 1963, nearly 200,000 CFA charterholders have successfully obtained the designation. They are employed internationally at nearly every major investment bank, asset management firms, hedge funds, consulting firms, private equity and more.

There is fast-growing demand for the CFA charter – candidate registrations have grown by an average of 7% per year 2012-2019, with 270,000+ candidates globally in 2019 (2020-2023 figures are impacted by pandemic postponements).

In particular, the year-on-year growth has been accelerating since 2015 – we expect this trend to continue given increasing demand from emerging markets.

The Chartered Financial Analyst Program is quite unique in the sense that it mostly sticks to the same 10 core topics across 3 levels, with increasing complexity and difficulty of testing as you progress. It consists of 3 levels, with each level’s exam split into 2 test sessions.

The computer-based CFA exams are conducted in English via in-person testing at 400+ exam sites around the world. Candidates can only register for the next exam level when they have passed their current level.

In terms of pass criteria, there are no negative markings for incorrect answers. The minimum passing score – which isn’t publicly disclosed but we provide estimates of – is determined by the exam committee each year.

Related articles:

CFA Level 1

Need to know the latest CFA Level 1 exam format, topic weights, study guide and cheat sheets? It’s all here.

This section has pretty much everything you need to know as a CFA Level 1 candidate and how to prepare for it well.

It may seem like a lot to go through at first, as the sage advice and tips were accumulated and refined over the past 10 years. Feel free to break things up, enjoy the slow read, come back to refer to it now and again.

Exam format

| CFA Level 1 Exam Structure | |

|---|---|

| Exam Frequency | Held 4x a year in Feb, May, Aug and Nov. See the latest CFA exam dates and our journey planner tool for more information to plan your registration. |

| Question format | Multiple choice questions (MCQ) |

| Exam Structure & Duration | Level 1 exam is 4.5 hours with 180 multiple choice questions (MCQ) in total, split into 2 sessions: – 1st session (2 hours 15 min) has 90 MCQ. It covers 4 topics: Ethics, Quant Methods, Economics, and Financial Reporting and Analysis – 2nd session (2 hours 15 min) also has 90 MCQ. It covers the remaining 6 topics: Corporate Finance, Equity, Fixed Income, Derivatives, Alternative Investments and Portfolio Management |

| Results Availability | Within 60 days of exam via email, with a simple pass or fail and a 2 page breakdown of your performance by topic. |

Topic weights

CFA Level 1 exam does not assume any prior finance knowledge, mainly focused on introducing candidates to a wide range of terms and concepts from the 10 main topic areas.

See below for the latest CFA Level 1 exam weights corresponding to the 10 topics:

| CFA Level 1 Topics | Weight (%) |

|---|---|

| Ethical and Professional Standards | 15-20% |

| Quantitative Methods | 8-12% |

| Economics | 8-12% |

| Financial Statement Analysis | 13-17% |

| Corporate Issuers | 8-12% |

| Equity Investments | 10-12% |

| Fixed Income | 10-12% |

| Derivatives | 5-8% |

| Alternative Investments | 5-8% |

| Portfolio Management | 5-8% |

Preparation, tips and advice

Before you embark on your CFA Level 1 preparation, here are some awesome resources and good advice to read through to ensure you start off on the right footing.

Notes, summaries and cheat sheets

For more help on studying and revision, check out our CFA Level 1 notes, summaries and cheat sheets by topic:

CFA Level 2

CFA Level 2 candidates, Level 2 is a big step up from Level 1. There’s more stuff to study with more technical details to learn, making it quite challenging if you continue to apply the same strategy as Level 1.

Start early, master your time management and practice loads! Check out this section for the best strategies to prepare and pass Level 2.

Exam format

| CFA Level 2 Exam Format | |

|---|---|

| Exam Frequency | From 2023, held 3x a year in May, Aug and Nov. See the latest CFA exam dates and our journey planner tool for more information to plan your exam registration. |

| Question format | Item-set based multiple choice questions (MCQ), whereby questions in each item set must be answered based on the information in the vignette. Each item-set has 4-6 questions related to it. Each question is worth 3 points. |

| Exam Structure & Duration | Level 2 exam is 4 hours 24 minutes with 88 MCQ in item set format in total, split into 2 sessions: – 1st session (2 hours 12 min) has 44 item-set MCQ. – 2nd session (2 hours 12 min) also has 44 item-set MCQ. |

| Results Availability | Within 60 days of exam via email, with a simple pass or fail and a 2 page breakdown of your performance by topic. |

Topic weights

CFA Level 2 exam builds on the foundation of Level 1, with a stronger focus on analyzing and applying the concepts learned. The Level 2 exams also consists of two sessions, each with 44 item-set style questions (multiple-choice) done in 2 hours 15 minutes.

See below for the latest CFA Level 2 exam weights corresponding to the 10 topics:

| CFA Level 2 Topics | Weight (%) |

|---|---|

| Ethical and Professional Standards | 10-15% |

| Quantitative Methods | 5-10% |

| Economics | 5-10% |

| Financial Statement Analysis | 10-15% |

| Corporate Issuers | 5-10% |

| Equity Investments | 10-15% |

| Fixed Income | 10-15% |

| Derivatives | 5-10% |

| Alternative Investments | 5-10% |

| Portfolio Management | 10-15% |

Preparation, tips and advice

CFA Level 2 is a big step from CFA Level 1 both in terms of breadth, depth and sheer volume of study materials to go through. Use these resources for the best strategy, guidance and inspiration to kickstart your studies properly.

CFA level 3

One more exam to go, CFA Level 3 candidates!

Constructed response or the ‘essay’ section is where most candidates experience difficulty in. Check out our comprehensive guides further below to master this section, focusing on succinct answers and time management, and you are one step closer to becoming a CFA Charterholder.

Exam format

| CFA Level 3 Exam Format | |

|---|---|

| Exam Frequency | From 2023, held twice a year in Feb and Aug. See the latest CFA exam dates and our journey planner tool for more information. |

| Question format | Level 3 has a mix of constructed response (essay) and item-based multiple choice questions (MCQ). Item-set based multiple choice questions (MCQ), whereby questions in each item set must be answered based on the information in the vignette. Each item-set has 4-6 questions related to it. Each question is worth 3 points. |

| Exam Structure & Duration | Level 3 exam is 4 hours and 24 minutes, split into 2 sessions. Both sessions are 2 hours and 12 minutes each, with item-set and constructed response (essay) now mixed within a session. So each session either has 6 item sets and 5 essay sets OR 5 item sets and 6 essay sets. Overall, the CFA Level 3 exam has 11 item sets and 11 constructed response sets, with 12 points each set. |

| Results Availability | Within 90 days of exam via email, with a simple pass or fail and a 2 page breakdown of your performance by topic. |

Topic weights

Finally, the Level 3 exam is heavily focused on applying what you’ve learned in portfolio management and wealth planning topics. It consists of two 2 hour and 12 minutes sessions, each session consists of a mix of constructed response questions (essay) and item-set questions.

See below for the latest CFA Level 3 exam weights corresponding to the 7 topics:

| CFA Level 3 Topics | Weight (%) |

|---|---|

| Ethical and Professional Standards | 10-15% |

| Quantitative Methods | – |

| Economics | 5-10% |

| Financial Statement Analysis | – |

| Corporate Issuers | – |

| Equity Investments | 10-15% |

| Fixed Income | 15-20% |

| Derivatives | 5-10% |

| Alternative Investments | 5-10% |

| Portfolio Management | 35-40% |

Preparation, tips and advice

You’re nearly there, one step away from becoming a CFA charterholder! CFA Level 3 is a different beast with the constructed response component, but there is a technique to it that you can master with practice and sound advice.

Find out how to best prepare for CFA Level 3 with the following resources:

CFA exam dates

CFA exams are held a few times a year depending on level:

- Level 1: 4 times a year in February, May, August and November.

- Level 2: 3 times a year in May, August and November.

- Level 3: twice a year in February and August.

Here is a summary of the latest CFA registration dates and deadlines, as well as our CFA Journey Planner tool you can use to map out your CFA pathway.

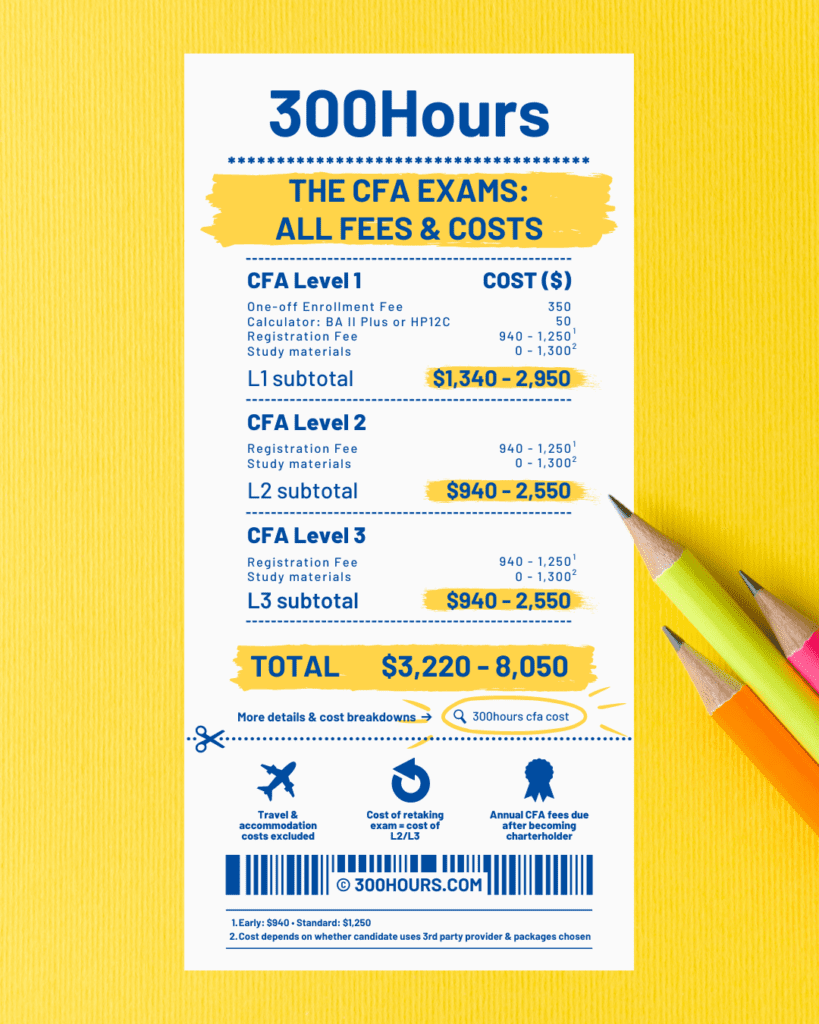

Cost and registration fees

The CFA enrollment and registration fees are just one aspect of the total exam costs to consider. With these tough exams, it’s likely that candidates would need to budget for third party study materials to help save time.

For the 3 levels of the CFA exam, a realistic estimate of a total cost range is $3,220-$8,050 to complete your charter, consisting of a $1,340-$2,950 budget for Level 1, and $940-$2,550 each for Level 2 and Level 3 respectively. This doesn’t account for retake costs if you failed though.

As fees are a big topic in itself, check out our infographic above, along with more details of a realistic CFA exam costs you’ll need to budget for.

Related content on CFA exam costs, scholarships and registration:

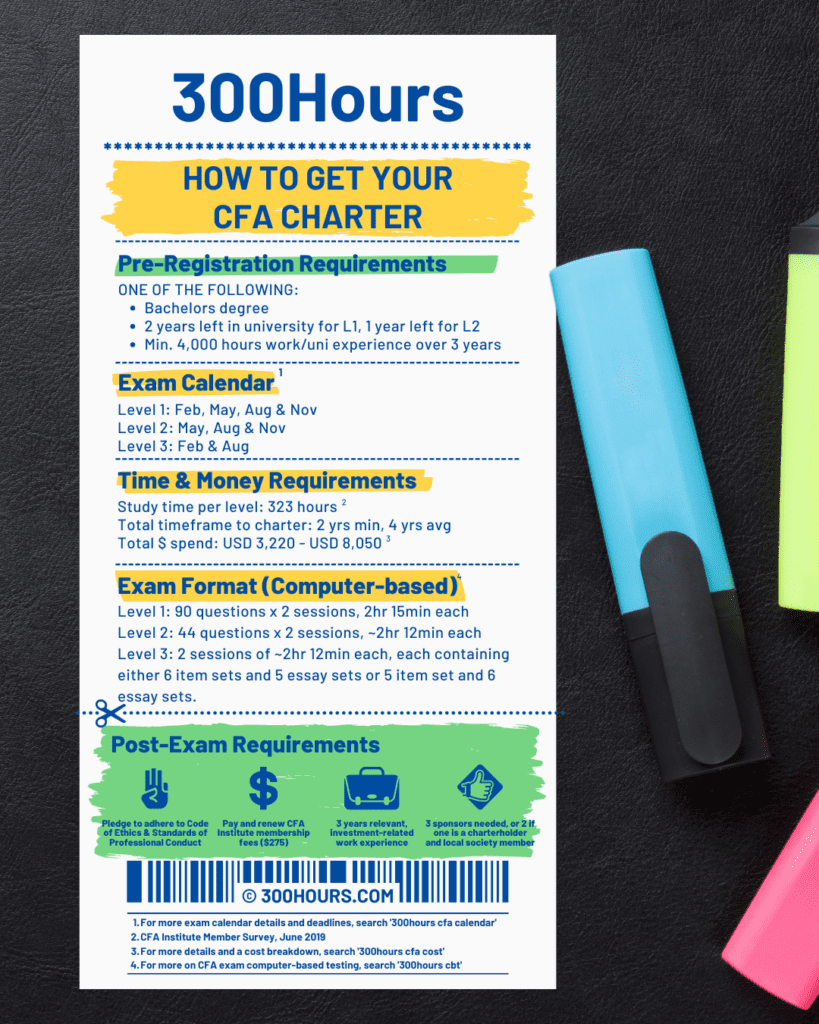

CFA requirements

CFA Level 1 requirements

To register in the CFA program as a Level 1 candidate, you’ll need to meet one of the following enrollment requirements:

- Have a Bachelor’s degree; OR

- Have 2 years remaining in a Bachelor’s program (or equivalent) for Level 1 registration. In particular, your selected exam window must be 23 months or fewer before your graduation month for your bachelor’s degree or equivalent program. Degree program must be completed prior to Level 2 registration; OR

- Upon Level 1 registration, you must have at least 4,000 hours of work experience and/or higher education that was acquired over a minimum of 3 consecutive years. If you have a combination of work experience and higher education to achieve the minimum hours and years, assume that higher education takes 1,000 hours per year.

For more details, check out our CFA entry requirements guide.

CFA charterholder requirements

In order to be become a CFA Charterholder and be able to use the CFA designation after your name, the following conditions must be fulfilled:

- Pass all 3 levels of the CFA exams;

- Have at least 4,000 hours of relevant work experience completed in a minimum of 3 years;

- Submit 2-3 professional references;

- Apply to become a regular member of CFA Institute (cost US$275 per year)

Learn more about the various CFA requirements with our in-depth guides:

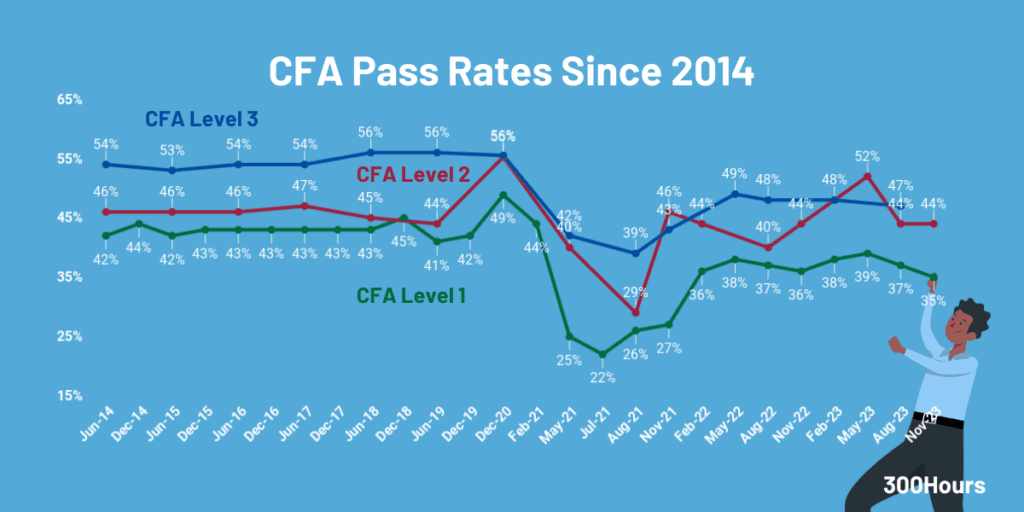

CFA pass rate and difficulty

The latest CFA exam pass rates are:

- 35% for Level 1 (Nov 2023)

- 44% for Level 2 (Nov 2023)

- 47% for Level 3 (Aug 2023)

As one would expect, the average pass rates increases as one progresses throughout the 3 levels. Since 2010, the historical pass rates for:

- Level 1 ranges from 22%-49%, with a 12-year average of 39%;

- Level 2 ranges from 29%-56%, with a 12-year average of 43%;

- Level 3 ranges from 39%-56%, with a 12-year average of 50%.

Sure, pass rates do give us a vague idea of the famously difficult CFA exams – but really, how hard are the exams?

Thankfully, we have an objective answer for you.

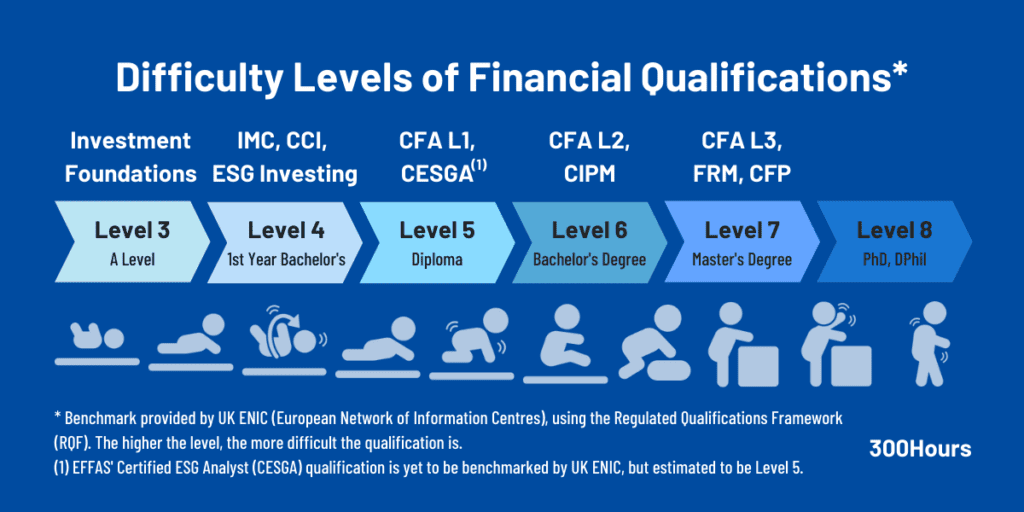

According to UK ENIC (European Network of Information Centres), the CFA exams have been benchmarked individually by Level under UK Regulated Qualifications Framework (RQF):

- Level 1‘s difficulty is comparable to a Diploma of higher education (Level 5 qualification under RQF);

- Level 2‘s difficulty is comparable to a Bachelor’s degree (Level 6 qualification under RQF);

- Level 3‘s difficulty is comparable to a Master’s degree (Level 7 qualification under RQF).

Considering that RQF Level 8 implies a difficulty equivalent to PhD programs, passing all 3 levels of the CFA exams is certainly not easy!

Related content:

CFA preparation: how to study

The strategies for CFA exam preparation differs by level, but they do have some similarities of consistency, hard work and effective study techniques.

For exam level specific advice, do refer to preparation sections of CFA Level 1, Level 2 and Level 3 above respectively.

This section focuses on 4 general aspects of good CFA exam prep that applies to all levels:

- Learn and apply effective study techniques to use your time efficiently

- Utilize our curated, free CFA candidate resources

- Understand how to choose the best, third party CFA study materials, if you’re getting them

- Practice makes perfect. Practice from a variety of CFA mock exams, practice questions and question banks

General study techniques

Check out our science-backed summaries on the most effective study techniques, ways to improve memory and how to focus when studying, even when you’re tired.

Free candidate resources

One of the main reason for CFA exam failure is lack of planning and time management. That’s why we have created a spreadsheet-based, customizable, free CFA study planner that has helped more than 80,000 of our readers pass the exams. Use these free resources to help your study plan and build up your study habits:

Besides that, here is a curated list of useful CFA calculator tips, free CFA study materials and useful apps to help your studies:

CFA study materials

The CFA curriculum is included as part of the registration cost. They alone are sufficient for studying and passing your CFA exams.

However, as they are part of the complete curriculum, they tend to be lengthier and perhaps unapproachable. For some candidates, especially those juggling a family or an intensive full time job, using a quality third party prep provider may make sense as they tend to be more succinct and save a lot of candidates’ time when studying.

There is no one size fit all solution here in the debate, as it also depends on your study absorption style (online lecture videos or reading), additional costs involved and most importantly the quality of the study materials available.

Here are a few top CFA prep providers that we recommend for a balance of quality, reputation, customer service, cost and efficacy:

CFA mock exams, practice questions and question banks

One of the most effective ways to learn and pass the CFA exams is by doing lots of practice questions and mock papers under timed, exam-like conditions.

We discuss the optimal number of CFA mock exams you should attempt, the target score to aim for and also include a roundup of the latest list of CFA practice questions to try for variety.

Learn more about:

Exam day and CFA results

Preparing for CFA exam day

With 4-6 weeks left to your exam day, aside from doing practice questions furiously, here are some useful checklist reminders and exam policies to help for the big day:

CFA results day

Wondering when CFA results are announced? Check out our latest predictions here, along with our results day FAQ and guide on how to interpret your CFA results charts.

Once you’ve received your results, our CFA minimum passing score (MPS) estimates are a useful reference point to understand how you performed in your exam.

Learn more about:

CFA benefits: Why CFA?

The CFA designation is the leading investment designation with worldwide recognition, and getting this certification certainly sets you apart from the rest.

Once you achieve this designation, you can expect to:

- Differentiate yourself and signal your credentials in the finance industry

- Enhance career growth and increase job mobility in the finance, investment or wealth management sectors

- Become a part of a prestigious, global group of CFA charterholders

- Be recognized globally as a leader in investment management

- Command better remuneration package and job opportunities

Find out more about:

Although top tier firms prefer to hire CFA charterholders, and there are many benefits to getting a CFA charter, it is worth remembering that this designation itself is not a golden ticket to jobs. Assessing whether CFA is worthwhile for you depends on your personal circumstances and career goals, and these informative guides can help you with that:

CFA vs other finance qualifications

The CFA Program is often compared to other finance designations as part of a potential candidate’s decision making process. Here’s a quick overview of the various global finance qualifications out there and what finance careers it is particularly relevant for:

| Qualification | Description |

|---|---|

| Chartered Financial Analyst (CFA) | A global, Masters degree equivalent certification administered by CFA Institute, specializing in advanced investment analysis. Broad generalist finance qualification which is particularly valued in asset/portfolio management, investment research, wealth management, and to a certain extent in financial planning, investment banking, private equity and corporate finance. |

| Certified Financial Planner (CFP) | A professional certification mark for financial planners administered by CFP Board (in the US) and Financial Planning Standards Board (FPSB, in 25 countries outside the US). Highly relevant for financial planners and advisors in the personal financial planning industry. |

| Certified Public Accountant (CPA) | A US-focused accounting designation provided to licensed accounting professionals in each state. A requirement for US accounting professionals who work in public accounting, i.e. firms that provide accounting and tax-related services to businesses. It is not a requirement for work in corporate accounting or private companies. |

| Masters in Business Administration (MBA) | A generalist postgraduate degree focusing on business administration, which covers many topics such as organizational behaviour, accounting, economics of management, marketing, human resources, operational management and much more. It prepares its graduates for a broad range of careers and is often used as a means to change careers/industries, secure a promotion or to move into management roles. |

| Financial Risk Manager (FRM) | A global, Masters degree equivalent certification administered by Global Association of Risk Professionals (GARP), specializing in financial risk management. Certified FRMs are highly sought after in risk management functions of financial institutions. |

| Chartered Alternative Investments Analyst (CAIA) | A global finance designation administered by CAIA Association that specializes in alternative investments such as hedge funds, private equity, real assets, commodities, and structured products. CAIA charterholders are often found working in sectors such as portfolio management, private equity, hedge funds, real estate investment, investment banking and venture capital. |

| Investment Management Certificate (IMC) | Administered by CFA Society of UK, IMC is an entry level qualification to the investment industry. It provides an excellent foundation into the core areas of portfolio management, research analysis, front office investment activities, relationship management and risk management. With no upfront requirements given its foundational nature, it is a great, lower cost stepping stone to the world of finance. |

| Investment Foundations Certificate | A cost effective, online course by CFA Institute which provides a basic introduction to the finance industry, global capital markets, investment tools and ethics in the global investment industry. |

The Chartered Financial Analyst designation covers a broader scope of financial analysis, portfolio management and investment topics, whereas FRM and CAIA are more narrowly focused on risk management and alternative investments specifically.

From a career building perspective, CFA, FRM and CAIA are quite comparable in their respective fields as they are globally recognized designations with ample employment opportunities. Plenty of finance professionals obtain one or two of these qualifications to better perform in their roles and career.

Ultimately, it all depends on your preferred career route: if you’re into risk management, FRM is the clear choice. If you’re less sure but keen on a career in finance, perhaps CFA is a better choice for a broader finance base. If you’re into alternative assets, CAIA is a good specialization to go for.

Here’s a quick summary comparing the three designations:

| CFA | FRM | CAIA | |

|---|---|---|---|

| Pre-exam qualifications | See CFA entry requirements for a summary. | None. There are no educational or professional prerequisites needed to register. | None. However, basic foundation in finance and quantitative aptitude is desirable. |

| Study Areas | 10 Topics: Ethics, Quantitative Methods, Economics, Financial Reporting & Analysis, Corporate Finance, Equities, Fixed Income, Derivatives, Alternative, Portfolio Management. | 10 Topics: Foundations of Risk Management, Quantitative Analysis, Financial Markets & Products, Valuation and Risk Models, Market Risk, Credit Risk, Operational Risk, Liquidity & Treasury Risk, Risk Management in Investment Management, Current Issues. | 8 Topics: Professional Standards and Ethics, Current & Integrated Topics, Asset Allocation & Institutional Investors, Private Equity, Real Assets, Commodities, Hedge Funds & Managed Futures, Structured Products. |

| Number of Exams | 3 levels (the fastest route is in 12 months, witha high chance of burn out) | 2 Parts (you can sit for both parts in one exam day) | 2 levels (unlike FRM, you cannot sit for both exams in the same exam window) |

| Exam Frequency | Level 1: 4x a year (Feb, May, Aug and Nov). Level 2: 3x a year (May, Aug and Nov) Level 3: 2x a year (Feb and Aug). | Part 1: 3x a year (May, Jul, Nov) Part 2: twice a year (May, Nov) | For both Levels: Twice a year in March and September. |

| Exam Format | Level 1: Multiple choice questions Level 2: Item set questions Level 3: Item set and constructed response questions | Part 1 & 2: Multiple choice questions | Level 1: Multiple choice questions Level 2: Multiple choice and constructed response questions |

| Pass Rates | The range of CFA pass rates since 2010: Level 1: 22%-49% Level 2: 29%-55% Level 3: 39%-56% | The range of FRM pass rates since 2010: Part 1: 39%-53% Part 2: 50%-62% | The range of CAIA pass rates since 2010: Level 1: 52%-74% Level 2: 56%-64% |

| Fees and Costs | One-off Enrollment Fee: $350 Registration fee (per level): $940-$1,240 Retakes: same as registration fee | One-off Enrollment Fee: $400 Registration Fee (per Part): $600-800 Retakes: same as registration fee | One-off Enrollment Fee: $400 Registration fee (per level): $995-1,395 Retakes: $450 per level (March 2023), $795 from Sep 2023. |

| Study Hours Needed | At least 300 hours per level | 200-250 hours per part | At least 200 hours per level |

| Post Exam Requirements | To become a CFA charterholder: Pass all the 3 levels of CFA exams; 4 years of qualified investment work experience; Submit reference letters for 2-3 professional references; Become a regular member of CFA Institute; Adhere to CFA ethics and professional conduct. | To become FRM-certified: Pass both FRM papers; a minimum of 2 years professional full-time work experience in the area of financial risk management or another related field; maintain membership. | To become a CAIA charterholder: Pass both levels of CAIA exams; Hold a bacherlor’s degree, or the equivalent, and have at least 1 year professional work experience; or alternatively, have 4 year professional work experience; Abide by CAIA’s member agreement; Pay CAIA membership fees. |

While famous for being difficult, the CFA designation can be a powerful boost to your resume as a finance specialist, given its global recognition and broad appeal.

Be it asset management, wealth management, research, corporate finance, consulting, risk management, banking, insurance, pension and even fintech etc, you can find CFA charterholders having a career in a broad range of sector and job functions.

CFA charter can be a particularly impactful investment in the earlier stage of your career, e.g. after 3-5 years work experience. It is a good choice for those committed to a career in finance while opening up a broader range of options for the future.