For those of you considering the CFA charter, today we will cover exactly what you will need to do in order to obtain and earn the right to use the CFA charter, in fine details – a complete guide on all the CFA requirements you need to be a CFA charterholder.

So all you need to do to become a CFA charterholder is:

- Pass all 3 CFA exams;

- Get relevant work experiences;

- Send 2-3 professional references;

- Apply to CFA Institute to become a CFA Charterholder.

We should know, we’ve been through the entire process ourselves! Let’s dive in:

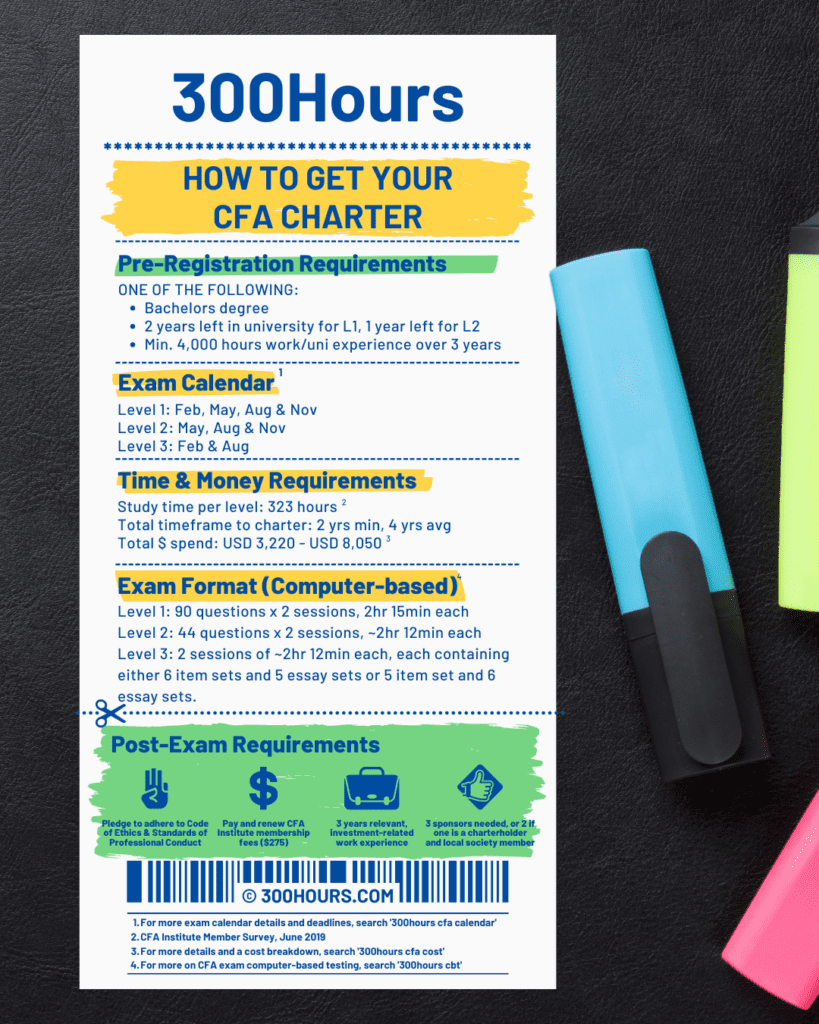

CFA requirements: a summary infographic

To blast off with a quick summary, this infographic sums up all the bases you need to cover to earn the CFA charter, plus key facts and figures.

The 3 Levels of CFA Program

The biggest-pain-in-the-ass part of earning the CFA charter is obvious – passing all 3 exams. Each level consists of 2 sessions, with an optional 30 minute break in between.

- Level 1: The first computer-based exam of the series is held 4x a year in Feb, May, Aug and Nov. Candidates can take it at most twice a year, given the ‘6 month rule’. This is generally regarded a relatively easy introduction to the CFA course. If you’ve taken Economics in college, a lot of this material may look familiar. However at 1.5 minutes a question, answering speed will be a key factor.

- Level 2: The second exam is held thrice a year (May, Aug and Nov). This is generally regarded as the hardest among the 3 exams. Although Level 2 only has half the number of questions compared to Level 1, the item-set format allows much more in-depth questions to be set. The breadth of the topics and sheer amount of material to cover is also a massive challenge.

- Level 3: Beware the essay question format in the first session – if you are not familiar with how to answer or study for the essay format, this level will be a heck of a challenge. The second session is identical to Level 2 format-wise – multiple choice item sets.

For more tips on how to approach and effectively prepare for each CFA level, check out these guides for each Level:

- How To Prepare & Pass CFA Exams in 18 Months: Level 1, Level 2 and Level 3 guides

- The 10 Commandments For Each CFA Exam: Level 1, Level 2 and Level 3 guides

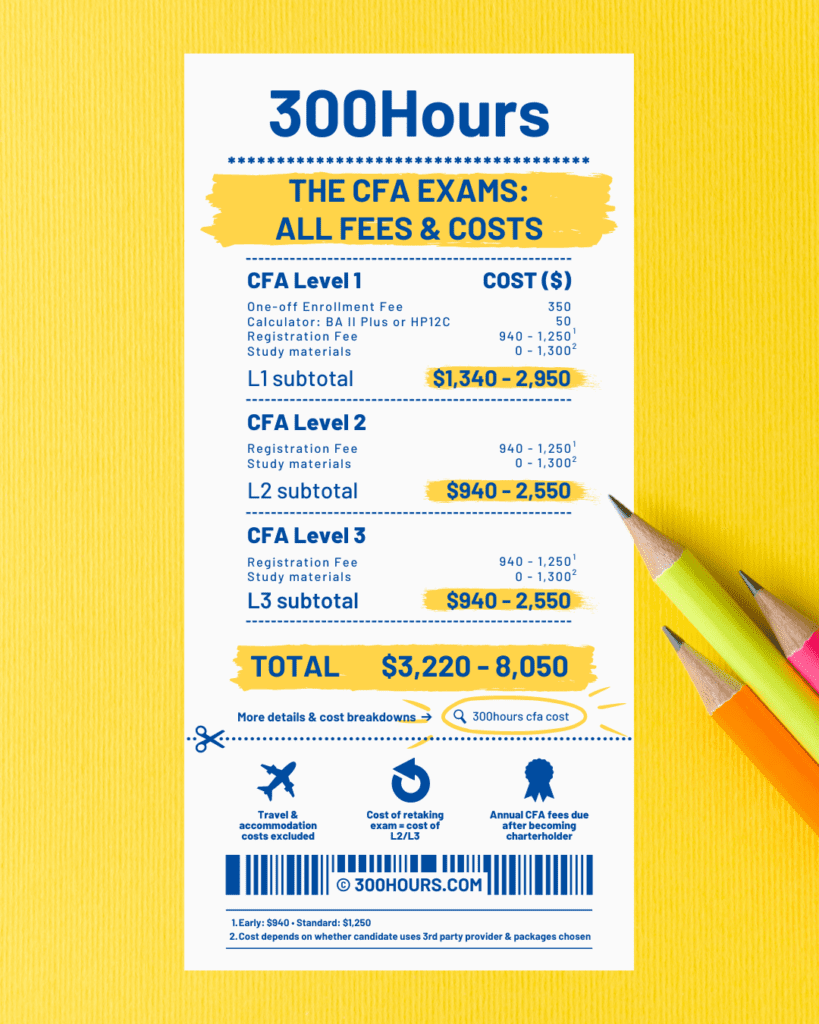

How long will CFA exams take, and how much will it cost me?

The time and monetary cost of your CFA qualification depends a lot on several factors:

- When you register for the exams (early or standard registrations)

- How much you spend on 3rd party materials (see our reviews here)

- How many attempts you need to pass all 3 exams

With all these variations, you can expect your CFA qualification to cost you about $3,220 to $8,050 in total. The minimum amount time needed to finish all 3 exams is just under 2 years (from registering for Level 1 to receiving your Level 3 results) but on average candidates take 4 years to complete the program.

Yay, I’ve passed CFA Level 3. How do I get my CFA charter?

Besides the exams, there are also several other requirements to earn the right to use the CFA charter, some much more easily achieved than others.

1) The Ethics Pledge

A straightforward but crucial part of being a CFA charterholder. The CFA Institute takes its members’ understanding and upholding of the CFA Code of Ethics & Standards of Professional Conduct very seriously, as illustrated by the exams’ emphasis on Ethics & Professional Standards. The pledge is thus a quick but important step in the registration process.

2) Relevant Work Experience Requirements

This is the other main barrier your CFA charterholdership after the exams themselves.

CFA Institute has updated its work experience requirements for CFA charterholders recently. CFA Institute now requires at least 4,000 hours of “relevant work experience”, completed in a minimum of 36 months.

3) 2 or 3 Professional References Required

You will also need references for your CFA Institute membership application. You’ll need:

- 2 professional sponsors if one of them is a current & regular member of the local CFA society you’re applying to, or

- 3 professional sponsors, if none of them is a current & regular member of the local CFA society you’re applying to.

Professional references from supervisors are preferred, although you can select other individuals who can describe and attest to your responsibilities in the investment decision-making process.

References will be asked to comment on your work experience and professional character. And obviously you cannot serve as a reference for your own application.

Note that although many candidates usually apply for memberships after passing the exams, there is no reason why you can’t do these first, e.g. if you wished to be an affiliate member of the CFA Institute, or get your work experience pre-approved.

4) CFA Institute membership and local societies

There is some confusion on membership types in the CFA Institute and its relevant regional CFA societies, and rightly so – available information can be fairly difficult to find, confusing, and sometimes omit crucial information.

The CFA Institute is the body responsible for maintaining and executing the CFA charter, CFA exams and curriculum. All membership applications require two sponsors to recommend you, one of which is a Regular Member of the CFA Institute, and the other your current supervisor. Memberships can be viewed in as 3 main types:

- Affiliate Membership – no exams or work experience required

- Regular Membership – pass your CFA Level 1 exam, acquire at least 4,000 hours of work experience over a minimum of 36 months and you can qualify as a Regular Member

- Regular Membership as a Charterholder – pass all 3 exams in addition to the Regular Member requirements to receive your charter

CFA societies are a local version of the CFA Institute – they are a separate body but exist to maintain a network of CFA charterholders and others involved in the investment profession. Applying to a local CFA society is a requirement for applying for your CFA Institute membership.

CFA societies often organize seminars, industry talks, social events and act as a career and industry network for your local region, so most of your networking benefits from the CFA program stem from being active in your local society. You can find a local society near you through the CFA Institute directory.

How long does the CFA membership application take?

CFA Institute’s regular membership applications’ review process takes up to 10 business days. Your application would also reviewed by the local society you applied to, which may take up to 1 month.

Once all application reviews are completed, you will receive an email letting you know your application review is complete.

Keeping your CFA charter

To maintain your charter after you earn it, you will need to continue to be a member of the CFA Institute with a $275 annual fee.

Should your membership expire you will no longer have the right to use your designation. If you forget to pay your membership fees one year and your membership expires, don’t worry, you can reactivate your membership at any time.

Note that although it is required to maintain membership with the CFA Institute, this requirement does not apply to your local society. After your first year if you wish you can choose to let your local membership expire and continue to be a member of just the CFA Institute to maintain your charter.

Hope this summarizes the key steps on how to get your CFA charter becoming a CFA charterholder, best of luck for your exams!

Meanwhile, here are other related articles that may be of interest:

I have 2.5 years of tech consulting experience and 2 years of Investment banking experience with Investment Banking working hours >4000. Can I apply for charter?

Can a CFA charterholder refer more than 1 candidate?

I got an error that a particular emailid had already been used for referring someone else in the past.

Also, I understand 3 references who aren’t CFA is also fine and should work, right? Preference is only for current supervisor

Hi there,

I come from a country A but currently work in country B. I was also passing Level II and III in the country A. Can I choose CFA Association in country A or the ‘local’ means I need to choose the country I currently reside in, i.e. country B?

regards,

Aibek

Hi Aibek, you should aim for country B’s CFA association as you’re working/practicing/residing there.

Hi Sophie

I also concluded that and chose country B in my application. Thanks for confirming it was the right thing!

Regards,

Aibek

…

Is there any exemption criteria for the CFA membership based on other professional qualifications.

Hi Hamid, we have an article on CFA exemptions you can refer to. In essence, there is no shortcut for CFA exams, but having the CFA charter does provide exemptions to various other professional qualifications, e.g. CAIA, PRM etc.

I thought anyone who knows you professionally could be your reference, no? And that if none of the references are CFA charterholders, then you need to have 3 references. I’m confused why it says “All membership applications require two sponsors to recommend you, one of which is a Regular Member of the CFA Institute, and the other your current supervisor”?

They prefer it that one of them is your direct supervisor, which makes a lot of sense. Quoting CFA Institute:

Got it, thanks for confirming!

I have completed CFA Level 1, II and III and required number of hours of work experience and hope to apply for the Charter. Do I need to submit my application to the local CFA society, before forwarding to the CFA Institute?

I believe CFA society membership will be completed together with your application for Regular Membership with CFA Institute.