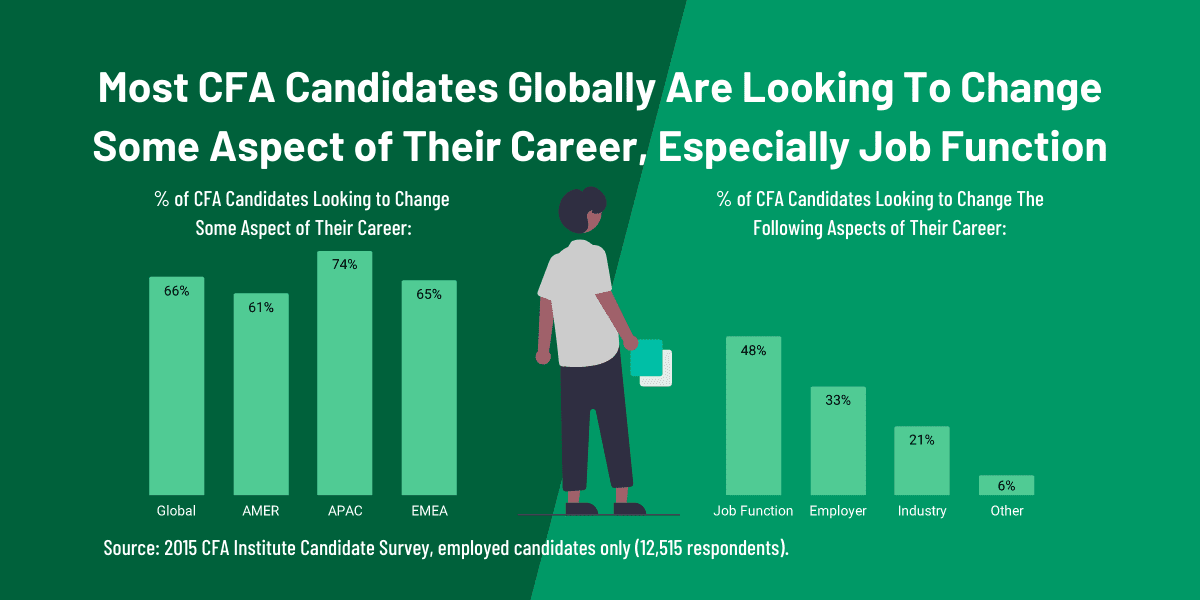

Did you know that 66% of employed CFA candidates globally are looking to change some aspect of their careers? 😲

Career changes can be hard as your pitch has to highlight why your career path so far makes you the best candidate for the job, in spite of the career switch. Especially if you want to change job function within the finance sector.

Our new Finance Career Change Planner guide should make this process easier:

- It’s designed to show you the most popular career switching paths to your target job, given an existing finance role.

- It’s comprehensive, data-driven and recruiter-approved.

- It’s free to use, yay! 🙂

Read on to find out more!

What are CFA candidates looking to change in their careers?

It’s worth bearing in mind that this survey data on career change focuses on employed CFA candidates only (76% of respondents) and excludes students (15% of respondents). This provides some useful insights into the career goals of CFA candidates who already have some work experience under their belt.

Based on CFA Institute’s 2015 survey, majority of employed candidates (48%) are keen to change their job function, followed by the desire to switch firms (33%) and change industries (21%):

- Changing employers (only) is arguably the most straightforward, as searching for the same job function within the same industry with different firms is the relatively easier change.

- On the other hand, 21% of the employed CFA candidates are looking to switch industry, presumably into the finance sector. We’ve seen lots of questions about career changes into finance, and a lot of it really depends on your personal circumstances. While taking the CFA exams to demonstrate your interest in finance is a useful first step, it is not a guarantee that you’ll get a finance job. That said, I’ve included some useful career change advice (from personal experience and speaking to finance recruiter friends!) at the end of this article to improve your chances of switching careers and industries.

- This article focuses on biggest chunk, i.e. job function changes: Our research-backed Finance Career Change Planner is designed to help CFA candidates change their job functions within finance, by charting the likeliest switching path given current job. And yes, the definition of finance sector is broader than you think, which is good news.

In this logical, step-by-step guide:

We will first take a look at current job roles CFA candidates are working in, understand what their target jobs are, and finally connect the dots on how to get those dream jobs with our recruiter-approved Finance Career Change Planner.

Let’s do this!

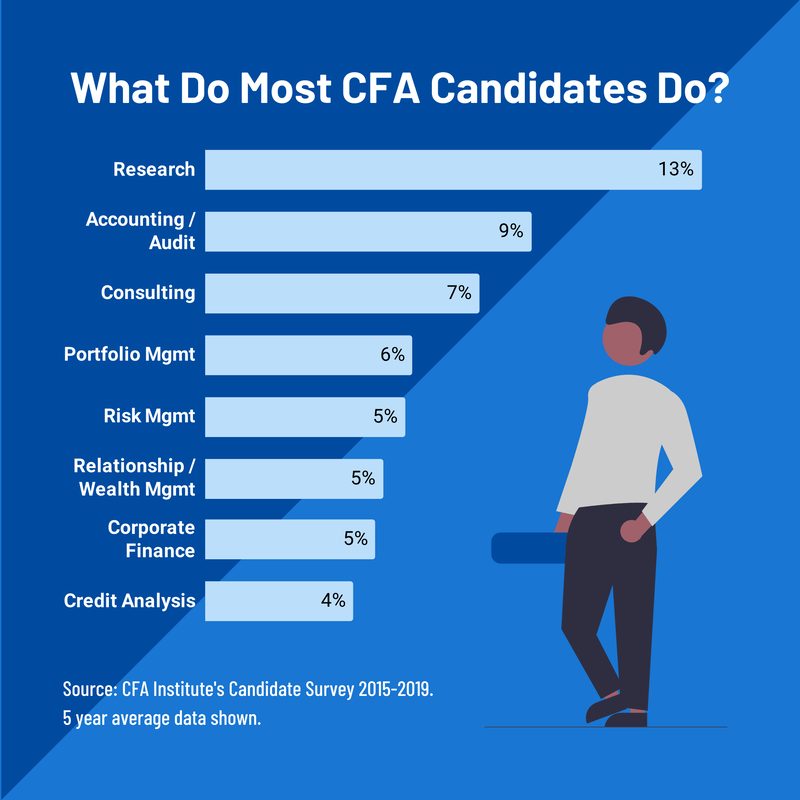

What do most CFA candidates currently do?

Comparing what CFA candidates do vs. CFA charterholders’ typical career paths, two interesting points stand out from a finance career switching perspective:

- Accountant and auditors are using CFA as a means to switch careers: 9% of CFA candidates coming from an accounting or auditing background (second highest group after Research), but only 4% of CFA charterholders that stayed in that career. Based on the survey data in the next section, this ties in with the view that CFA candidates currently in accounting/auditing roles are taking the CFA exams in hope to switch careers into other areas of finance (especially Corporate Finance, Investment Banking and Financial Planning).

- Portfolio Management is a popular target career for CFA candidates: With only 6% of CFA candidates in the portfolio management sector compared to 25% of CFA charterholders, the CFA qualification is likely an effective way for candidates to move into this sector. I suppose we all knew that already, but more interesting data on this point in the next section!

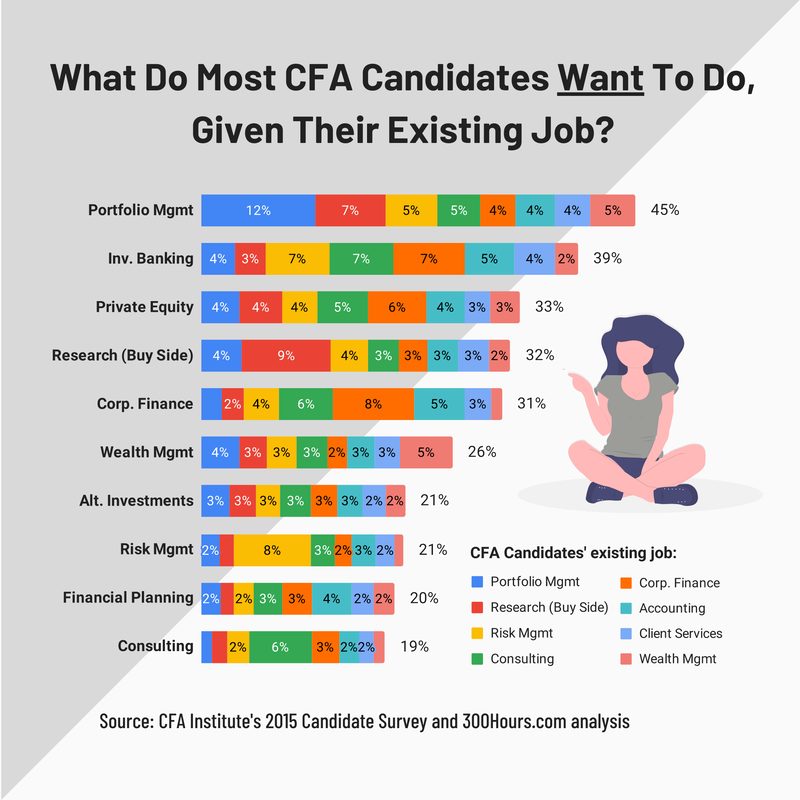

What jobs are CFA candidates interested in pursuing, given their existing roles?

This chart is jam-packed with lots of information, let’s go through them to see what we can learn for individuals wanting to change their financial career:

- What finance sectors are popular target careers for CFA candidates in general?

- The top 10 most popular jobs CFA candidates would like to explore in the next 5 years are Portfolio Management (45% of candidates), Investment Banking (39%), Private Equity (33%), Buy-Side Research (32%), Corporate Finance (31%), Wealth Management (26%), Alternative Investments (21%), Risk Management (21%), Financial Planning (20%) and Consulting (19%).

- For a given interest in a target job sector, what jobs are these candidates currently working in? This may provide a partial gauge of transferable skills or ease of switching financial careers from a current role to the target career path. Here are some learnings and examples:

- 7% of candidates who are currently working in Buy-side Research are interested in exploring a Portfolio Management career.

- There isn’t sufficient data of candidates wanting to switch out of Private Equity. Also, only 4% of candidates who are currently working in Portfolio Management are interested in a career in Buy-side Research. There seem to be an inherent preference for certain jobs, perhaps due to (perceived or not) better work-life balance, higher pay/prestige, more engaging job nature etc.

- 7% each of candidates who are currently working in Consulting, Corporate Finance and Risk Management respectively, are interested in exploring an Investment Banking career. From my experience, while I can see clear transferable skills from Consulting and Corporate Finance to Investment Banking, that link isn’t clear to me for Risk Management. So yes, the story isn’t complete (yet), but this is an important point, bear with me, the next section is coming up! 🙂

- For a given job sector a candidate currently works in, what are the most popular target career paths? Again, this could provide a sense of realistic yet relevant potential exit options for other candidates who are considering a career change. Here’s an example:

- Candidates currently in working Consulting and Accounting stood out as the ones with the broadest interest in other job functions, with that figure rarely dropping at 2% or below and evenly distributed across the top 10 target jobs. Is this an indication that consultants and accountants have broad transferable skills valued in the finance sector?

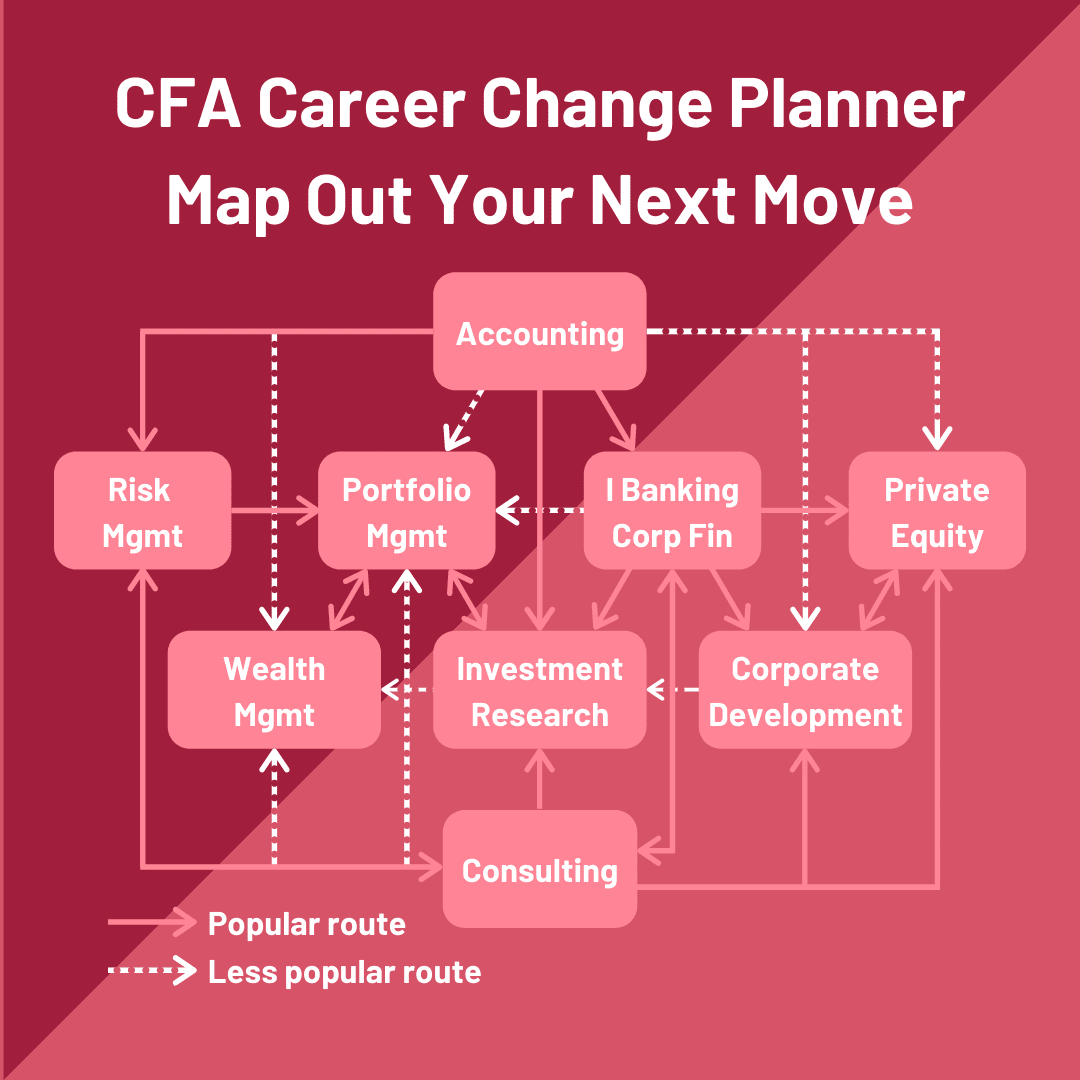

Finance career change planner: Popular career switching paths to target finance jobs

OK, so now we know what CFA candidates currently do, and what their dream jobs are.

How do we connect the dots and make the career change work? There are still some questions unanswered:

- How does one switch job functions to get to their preferred career path?

- Are there careers with transferable skills or typical exit routes that make career switching to other finance sectors easier?

- What is the likelihood of someone changing to a new job function given their current finance role?

To find out these answers, I’ve extensively interviewed 3 finance recruiter friends covering these sectors, who specialize in recruitment of candidates with 1-9 years finance work experience.

Combining all these information, here’s our ultimate Finance Career Change Planner for candidates and charterholders!

Our Finance Career Change Planner is designed to show the most popular career switching paths to a particular target job, given an existing finance role.

In other words, this planner helps you determine what exit options you have with the highest probability of success. A few things to note:

- The chart focuses on career switching paths for job seekers with 1-9 years of finance work experience, i.e. junior to senior manager level.

- The directional arrows indicate the likeliest path with the most data, with a strong and weak indicator to show frequency. It does not mean you cannot switch from one sector to another if the arrows aren’t there, or are in the opposite direction, it is just a less popular route/choice 🙂

- Financial Planning and Alternative Investments are not covered despite being in the top 10 desired jobs by CFA candidates due to insufficient recruitment data.

- We’ve combined Investment Banking and Corporate Finance as the same category due to similar nature of work.

- Corporate Development is a new job function we’ve added as it is a popular and interesting role that many finance job seekers should be aware of.

So what can we learn from the CFA Career Change Planner?

| Job Function | Notes / Comments |

|---|---|

| Accounting | Typical exit options: Investment banking, corporate finance, research. Accountants have sought after accounting knowledge applicable in many other finance sectors, especially at a junior level. |

| Consulting | Typical exit options: Investment banking, research, private equity and corporate development. Consultants have a broad analytical skillset and industry knowledge that are transferable to other finance sectors (both buy side and sell side), especially at the manager level. |

| Risk Management | Typical exit options: Consulting and portfolio management. Generally, people working in risk management are specialized and happy to stay at their role. This is probably due to the relatively lower burn out rates compared to the other job functions listed here. |

| Private Equity (PE) | Typical exit options: alternative investments (not shown in chart) and corporate development. Private equity firms tend to hire junior bankers, consultants or accountants with less than 5 years experience to join at a senior analyst or manager level. Roles in PE start to heavily specialize in certain sectors or asset classes, hence the typical exit routes reflect that specific expertise. |

| Investment Banking / Corporate Finance | Typical exit routes: private equity, investment research and corporate development. A great starting point in finance with high transferable skills to various other sectors. Analysts and associates (1-6 years work experience) typically exit to other finance jobs in search for better work-life balance with similar nature of work. |

| Corporate Development | Typical exit routes: investment research and private equity. Corporate development focuses on acquisitions, divestitures, joint venture deals, and partnerships internally at a company. Depending on how the team is structured at a company, sometimes corporate finance and business strategy are grouped together in that team. It can be an interesting alternative for candidates in investment banking, consulting, private equity and research who would like to move to the ‘industry’ and gain sector expertise, with a broader range of work and better work-life balance. |

| Investment Research | Typical exit routes: portfolio management, alternative investments. Research is a frequent stepping stone to portfolio management and hedge funds. It’s also common to switch between buy-side and sell-side. |

| Portfolio Management | Typical exit routes: investment research, alternative investment and wealth management. Most CFA candidates in portfolio management are happy with their role, with minimal desire to switch job functions. It has a good work-life balance and competitive pay, depending on sector and asset class specialization. |

Top 5 career change advice & tips

1) Switching job function and industry? Gradual change may work better

Changing careers into finance is difficult as is, but switching job function at the same time may prove challenging, unless you don’t mind starting at the bottom again. And sometimes that isn’t an option at all at a more experienced level.

For an easier pitch to recruiters and employers, a better strategy may be to first aim for an industry change into finance, without the job function change at this stage. Breaking it down in two steps may increase your chances of securing a job in the finance sector, while building your network internally for your future target job.

2) Invest in a good resume/CV, it makes a difference

Make sure your resume and LinkedIn profile is up to date, else learn how to write a good one.

Otherwise, it may be worth getting your CV professionally updated/written by companies like TopResume. Remember to craft your career change narrative – your unique story and background of why you’re an awesome (or an even better) hire in spite of the career change.

Your chances of securing a job offer dramatically improves if offered an interview, and the goal of your CV is to get you an interview. I think that makes a good investment.

3) Reach out and network with recruiters as well

Often not mentioned, but I found recruiters a great source of insights to what works and what doesn’t for a particular job.

After you’ve updated your CV, reach out to a few finance recruiters and offer to bring them out for a coffee (or a video call). They should know what employers want and by getting ahead of the game, it will show them that you’re proactive which helps set you apart from the competition. When you have an idea of what skills they look for in a potential hire, focus your efforts on those areas.

4) Upgrade your skillset

Once you know what employers look for in a particular job function, assess your skills and interest to see if you fit that profile.

If not, you may want to consider volunteering your time in related roles (at work or personally) to gain relevant experience, or take up a course to upgrade your skills.

5) Understand that career change is a marathon, not a sprint

Manage your own expectations that it takes time and effort for a meaningful career change. Especially with the current market conditions.

Stay motivated, keep taking small, consistent actions towards your career goals. You will get there in the end.

Wow, that was a long one! If you’ve made it to the end, leave a comment about your career change plan with us 🙂

Meanwhile, here are other awesome career-related resources which you may find useful:

- 6 Clear Steps on How to Change Careers

- What Are Typical Career Paths for CFA Charterholders?

- How To Properly Display Your CFA Status On Your Resume, LinkedIn & Business Cards

- How To Write A Good Resume: 11 Solid Tips

- Is TopResume Worth It? I Paid for One, Here Are My Thoughts

- The CFA Charter is Not a Golden Ticket to Jobs – But Here’s How It Can Help

Well detailed and easy to understand. Thank you for being a value add as always.

You’re very welcome!

Thank you I enjoyed reading it. I’m now more equipped towards my CFA journey.

I see. Thanks Sophie!

Hi, what do you think about MBA? will it help to ease the transition from audit to investment banking or portfolio management? Do you think it is worth the investment if a person already has CFA?

Hi Michelle, I think if you already have a CFA, then adding an MBA on top of it may be unnecessary (although it certainly would not hurt) if your goal is to switch from audit to PM. You already have the credentials and skillset that are sought after in these 2 sectors, just have to focus on applying and interviewing well for a job. Having an MBA can only help your case more, but in my opinion may be an expensive/high cost way with no guarantee of switching successfully.