The CFA exam results day for the Feb 2024 CFA exams will be announced on 4th April and 9th April (Level 3, estimated date) respectively.

Remember that you can track all important events by syncing with our CFA Calendar, including our predicted exam results dates.

CFA results day can be a bit chaotic – that’s why in anticipation of results day, we’ve put together a few FAQs about results day that you’re like to wonder about, regardless of whether it’s your first time receiving it or not.

If you’ve got an additional question, simply drop it in the comments and you’ll get an answer from us!

#1 – How will CFA exam results be delivered?

The CFA results used to be posted on the CFA Institute website, and you had to log into the website to check your results. Naturally, this crashed their website every results day, and after several years CFA Institute switched to delivering full detailed results via email.

On results announcement day, CFA Institute now emails you just a pass/fail grade. Additional details, including your results charts, will be available online on the same day, but you may have issues logging into the website due to heavy traffic.

The results email is now a lot shorter than what it used to be:

Passed CFA email example:

Congratulations! We are very pleased to inform you that you passed the February 20XX Level X CFA exam. XX% of candidates passed the February 20XX Level X CFA exam.

Failed CFA email example:

We sincerely regret to inform you that you did not pass the February 20XX Level X CFA exam. XX% of candidates passed the February 20XX Level X CFA exam.

You can find out more about how to interpret your CFA results charts here.

#2 – When will my CFA results email come? I’ve been waiting for hours!

On results day, results emails have historically arrived some time after 9AM ET – equivalent times in major timezones:

- PST: 6AM

- UK: 2PM

- Europe: 3PM

- India, Pakistan: 6.30PM

- China, Singapore: 9PM

This time CFA Institute has not quoted any time, but you can expect results to be emailed some time after 9AM ET. This could mean hours after 9AM ET, so don’t plan to sit by your inbox and wait!

You can check the exact corresponding time in your local timezone using the button below. You can also add our free CFA Calendar to your calendar so that you’ll be reminded of important upcoming CFA events!

Emails may take several hours from this time to land in your inbox – remember, there are thousands of emails being sent.

The 300Hours team will all be active at the Forum, so drop by there to hang out while you wait for your results, and if you have any questions we’d be happy to answer!

Tip: Can’t wait for the email? Check directly online!You can also check your results online from 9AM ET onwards, sometimes even earlier. However, CFA Institute’s website might experience exceptionally heavy traffic on results day so you may have technical issues logging in.

#3 – How are the CFA results presented? Do I get a breakdown?

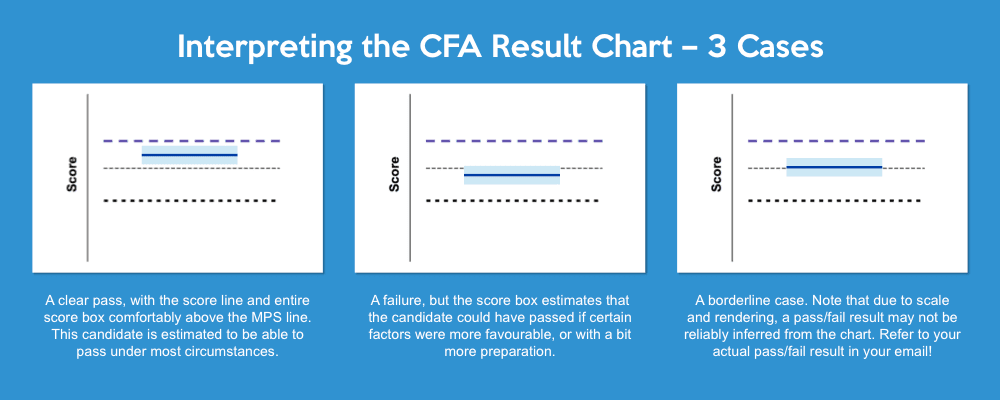

With the current format, candidates get charts showing the relative positions of:

- the Minimum Passing Score, MPS (or 70% mark depending on the score being reported)

- the 10th and 90th percentile

- your ‘score box’ (i.e. the range, according to CFA Institute, that you should have been capable of)

- your score

These are all represented by charts with no displayed x or y values, which means candidates don’t get a full breakdown of their performance, just a relative sense.

We do, however, have a guide to help you interpret your results charts effectively.

#4 – What are the next steps if I pass or fail?

Firstly, if you passed, congratulations!

Exam registrations will open after results day so you can register yourself as a candidate for the next level then! Be sure to check out the top 10 tips from previous candidates and charterholders for the next level in our Free Guides section. As for partying, I’m sure you need no pointers from us!

If you failed, don’t give up! More than 70% of readers have indicated that you would retake the exam immediately – I completely agree with this frame of mind. Failing is simply an indication that you should change your methods, or put in more effort – don’t give up on the dream! Make sure you have all the necessary tools for this time around.

#5 – If I fail, can I get a retabulation?

Unfortunately, retabulation is no longer an option with computer-based exams (CBT).

Previously if you failed a paper-based exam, you can request for your exam score to be retabulated.

Retabulation only confirms your scores are calculated correctly – it’s not an appeals process, nor a remarking of your paper. With CBT exams, this is automatically calculated by the computer anyway, so this is no longer a relevant option with human error eliminated.

All the best for results day – all our fingers and toes will be crossed for all of you. Meanwhile, if you’ve got another question for us, drop it in the comments below!

Meanwhile, here are some related articles that may be of interest:

Hello

Greetings!

I have scored more than 70 % in 6 subjects, more then 50 percent in 3 subjects and 50 percent in 1 subject. I think the percentage I scored are satisfactory. How come I did not pass.

With an estimated MPS of 72.5%, “more than 70%” even in every category is no longer a guarantee of passing. You can find more information on our estimated MPS in this article.

How can we apply for retabulation

Hi Neha, it seems that for CBT exams the retabulation option is removed from CFA Institute’s website, see this forum post for more details. Sorry I couldn’t be more helpful.

Hey, i have scored good in the first session of the exam, that is in the main subjects, but in the other half i have found very poor result and have not passed in the exam.

I was really confident about the exam, should i try for retabulation????

Hi Ridhi, I’m sorry to hear you didn’t pass, it must have been a real close call.

It seems that for CBT exams the retabulation option is removed from CFA Institute’s website, see this forum post for more details. Sorry I couldn’t be more helpful.

Hello Ridhi,

I seem to be that you’re in same my situation. My constituent point for every subject sounds good, 8/10 subjects were from 70 and above. But final result, I failed. I can’t understand the result and sent email to CFA Institute for asking.